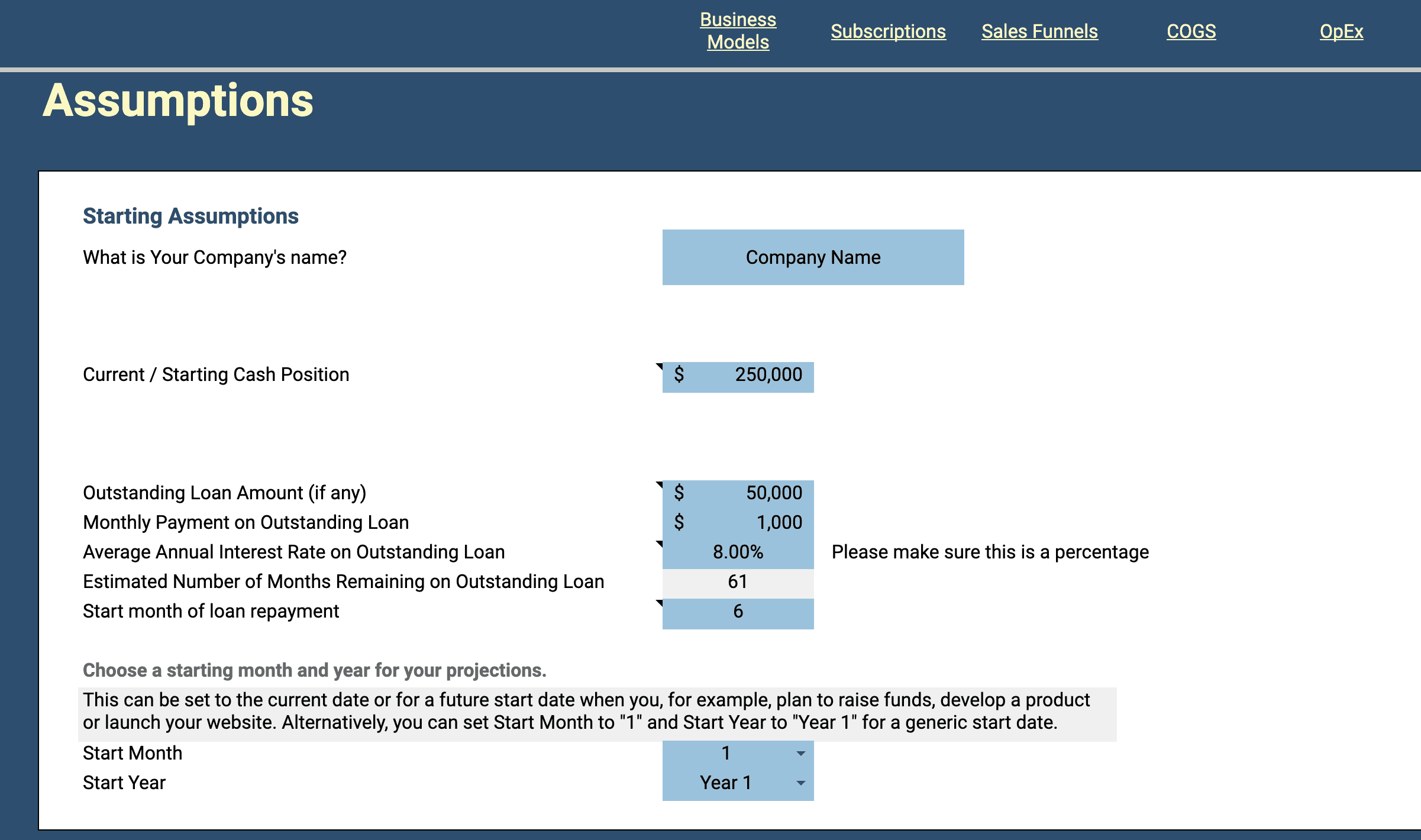

Starting Assumptions

Dec 15, 2022

Click on the Assumptions tab and navigate to the "Starting Assumptions" section at the top of the sheet. Answer the following questions about your business:

Company Name

This is completely optional and can be left blank if you don't have a company name yet.

Current / Starting Cash Position

Enter the amount of liquid cash you have in your bank account(s). This number includes any cash you have on hand as a result of a prior funding round or loan.

This sets your initial cash position. If you don't have any cash in the bank, set this value to zero.

Outstanding debt connected to the business is entered in the field below.

Outstanding Loan Amount (if any)

If you have an outstanding loan, include the total balance as of the start date of the model (see the stating date fields below), monthly payment amount, annual interest rate, and the month when you start making payments on the loan (if you are currently making payments, set this variable to 1). The estimated number of repayment months is automatically calculated.

Repayment information here will be reflected in your balance and cash flow statements.

Start Date

Select a month and year for the start of your forecast. This can be set to the current date or for a future start date when you, for example, plan to raise funds, develop a product or launch your website. Alternatively, you can set Start Month to "1" and Start Year to "Year 1" for a generic start date.

—

Now you're ready to set up your revenue model.